In recent years, the financial landscape of Missouri has been evolving, with the emergence of innovative banking solutions catering to diverse needs. Among these, the Indigo Card Bank of Missouri stands out as a beacon of financial inclusivity and convenience. Established with a vision to revolutionize banking experiences, the Indigo Card Bank brings forth a myriad of features and benefits aimed at enhancing customer satisfaction and accessibility.

Understanding the Indigo Card

What is the Indigo Card?

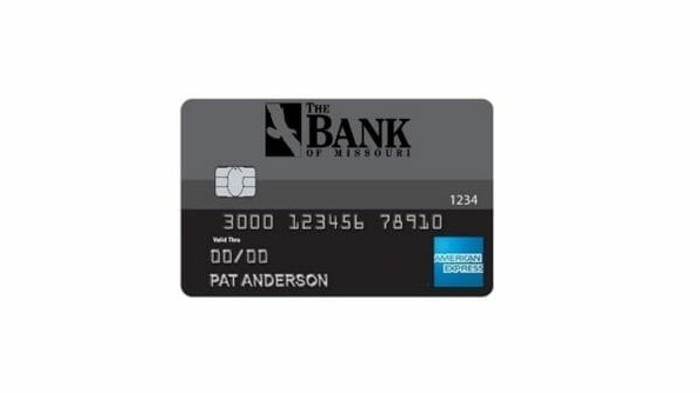

The Indigo Card is a financial product designed to offer individuals a seamless banking experience, irrespective of their credit history or financial background. Unlike traditional banks, the Indigo Card Bank focuses on providing accessible banking solutions to underserved communities, ensuring that everyone has the opportunity to manage their finances effectively.

Features and Benefits

With features such as online account management, mobile banking apps, and personalized customer support, the Indigo Card offers unparalleled convenience to its users. Additionally, the Indigo Card’s commitment to financial education and empowerment sets it apart, providing customers with the tools and resources needed to make informed financial decisions.

Why Missouri?

Reasons Behind Choosing Missouri

Missouri’s vibrant economy and diverse population make it an ideal location for the Indigo Card Bank’s operations. With a strong emphasis on community engagement and financial inclusion, Missouri aligns with the bank’s core values, providing a fertile ground for growth and expansion.

Economic Landscape of Missouri

The robust economic infrastructure of Missouri, coupled with its strategic location and thriving business ecosystem, presents numerous opportunities for the Indigo Card Bank to thrive. Moreover, the state’s commitment to innovation and entrepreneurship further enhances its appeal as a conducive environment for financial institutions.

Partnership and Expansion

Collaborations for Growth

To accelerate its growth trajectory, the Indigo Card Bank has forged strategic partnerships with local businesses and organizations, leveraging synergies to enhance its product offerings and reach. Through collaborative efforts, the bank aims to expand its presence across Missouri and beyond, bringing its innovative banking solutions to a wider audience.

Future Plans

Looking ahead, the Indigo Card Bank is poised for exponential growth, with plans to diversify its product portfolio and enhance customer experiences. By leveraging technology and innovation, the bank seeks to stay ahead of the curve, continually adapting to meet the evolving needs of its customers.

Accessibility and Convenience

Branches and Online Services

In addition to its physical branches, the Indigo Card Bank offers comprehensive online banking services, allowing customers to manage their accounts conveniently from anywhere, at any time. This blend of traditional and digital banking channels ensures maximum accessibility and flexibility for users.

Mobile App Features

The Indigo Card’s mobile banking app provides users with a seamless banking experience on the go. From account management to bill payments and fund transfers, the app offers a wide range of features designed to streamline banking processes and enhance user satisfaction.

Financial Inclusion

Serving the Underserved

One of the key pillars of the Indigo Card Bank’s mission is to promote financial inclusion by providing banking services to underserved communities. Through targeted initiatives and outreach programs, the bank aims to empower individuals with the tools and resources needed to achieve financial stability and independence.

Community Initiatives

Beyond banking services, the Indigo Card Bank actively engages with local communities through various social and philanthropic initiatives. By supporting education, healthcare, and economic development projects, the bank demonstrates its commitment to making a positive impact on society.

Customer Experience and Satisfaction

Testimonials and Reviews

The Indigo Card Bank prides itself on delivering exceptional customer experiences, as evidenced by glowing testimonials and reviews from satisfied customers. From prompt customer support to hassle-free banking processes, customers consistently praise the bank for its dedication to service excellence.

Commitment to Service

At the heart of the Indigo Card Bank’s operations lies a steadfast commitment to serving its customers with integrity and professionalism. Whether through personalized advice or timely assistance, the bank goes above and beyond to ensure that every customer’s needs are met with the utmost care and attention.

Security and Trust

Safeguarding Customer Data

Recognizing the importance of data security and privacy, the Indigo Card Bank employs robust security measures to safeguard customer information. From encryption protocols to stringent authentication procedures, every precaution is taken to ensure the confidentiality and integrity of customer data.

Compliance and Regulations

As a responsible financial institution, the Indigo Card Bank adheres to all relevant regulations and compliance standards, ensuring transparency and accountability in its operations. By upholding the highest ethical standards, the bank earns the trust and confidence of its customers and stakeholders.

Competitive Advantage

What Sets Indigo Card Bank Apart?

In a crowded banking landscape, the Indigo Card Bank distinguishes itself through its unwavering commitment to customer-centricity and innovation. By prioritizing inclusivity, accessibility, and customer satisfaction, the bank has carved a niche for itself in the market, earning the loyalty and trust of customers across Missouri.

Comparison with Other Banks

Unlike traditional banks that may impose stringent eligibility criteria and fees, the Indigo Card Bank offers a refreshing alternative, catering to individuals from all walks of life. With transparent fee structures and flexible account options, the bank ensures that banking services remain accessible and affordable for everyone.

Future Prospects

Growth and Innovation

As the Indigo Card Bank continues on its growth trajectory, the future looks promising, with endless possibilities for innovation and expansion. By staying true to its core values and leveraging emerging technologies, the bank is well-positioned to lead the way in shaping the future of banking in Missouri and beyond.

Vision for the Future

Looking ahead, the Indigo Card Bank envisions a future where banking services are not just accessible but truly empowering for all. Through continuous innovation and collaboration, the bank aims to redefine the banking experience, making financial services more inclusive, convenient, and impactful for individuals and communities alike.

Conclusion

In conclusion, the launch of the Indigo Card Bank of Missouri marks a significant milestone in the state’s banking industry, heralding a new era of accessibility, inclusivity, and innovation. With its customer-centric approach, commitment to service excellence, and focus on community empowerment, the bank is poised to become a trusted partner for individuals and businesses alike, driving positive change and transformation in the financial landscape of Missouri.

FAQs (Frequently Asked Questions)

- Is the Indigo Card Bank of Missouri open to everyone?

- Yes, the Indigo Card Bank welcomes individuals from all backgrounds, including those with limited or no credit history.

- What makes the Indigo Card Bank different from traditional banks?

- Unlike traditional banks, the Indigo Card Bank prioritizes accessibility, inclusivity, and customer satisfaction, offering flexible banking solutions tailored to individual needs.

- Can I access my Indigo Card Bank account online?

- Yes, the Indigo Card Bank provides comprehensive online banking services, allowing you to manage your account conveniently from anywhere, at any time.

- How does the Indigo Card Bank ensure the security of customer data?

- The Indigo Card Bank employs state-of-the-art security measures and compliance protocols to safeguard customer information and ensure data privacy.

- What are the plans of the Indigo Card Bank?

- The Indigo Card Bank aims to expand its presence, diversify its product offerings, and continue innovating to meet the evolving needs of its customers.