Knowing and providing the proper routing number for your specific Indigo card account is necessary for many common financial activities:

- Set up direct deposit for paychecks, tax refunds, or benefits payments like Social Security. The routing number gives your employer or benefits provider address information to send payments electronically into your account.

- Authorize transfers between your Indigo account and accounts at other institutions. The routing number identifies your account as the destination for withdrawals, deposits, or balance transfers.

- Pay bills online through Indigo’s bill pay system. The routing number links your Indigo checking or savings account to make payments.

- Receive payments from clients, employers, or other individuals. Providing the routing number along with your account number allows payers to transfer funds directly into your account.

- Sign up for Indigo’s rewards programs. Linking your credit card or checking account via the routing number may allow you to earn more rewards through eligible transactions.

Having the correct routing code for your card helps facilitate key financial activities through proper identification of your account. It paves a smooth path for your money to reach its intended target.

Where to Find the Indigo Card Routing Number

Indigo provides the routing number for your specific account in several places:

On your Indigo Card Checks

For checks linked to Indigo checking or money market accounts, you can find the routing number printed along the bottom left edge. It will appear after the 9-digit account number, labelled as “Routing Number” or “RTN.” Match it to the specific check number for that account.

On Indigo Deposit Slips

When making deposits through an ATM or at a bank branch, your deposit slip will display the routing number below the account number. It may read “ABA Routing Number” or “RTN.” This code pertains to the account where you intend the funds to be deposited.

Within the Indigo Online Banking Portal

After logging into your secure Indigo online account, navigate to the account settings or profile section. Along with other account details, the system will display the bank routing number associated with each of your accounts.

By Calling Indigo Customer Service

You can also obtain the routing number for any of your Indigo accounts by calling the customer service number printed on the back of your debit card or account statement. A representative can provide the 9-digit code over the phone after verifying your identity.

How the Routing Number Works

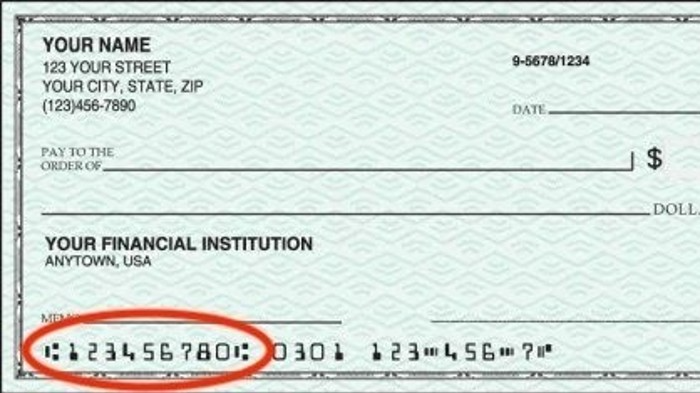

The routing number serves as part of the banks’ internal address system to sort and direct money to linked accounts. It forms a core component of the MICR line printed on checks using magnetic ink.

Magnetic Ink Character Recognition (MICR)

- The MICR code printed along the bottom of paper checks contains the routing number, account number, check number and other data.

- The code is printed using a special magnetic ink that allows the digits to be easily read and processed by automated check-clearing machines.

- As a check passes through the banking system, the routing number is one factor that tells the clearing system where to direct that check for payment. It acts like a ZIP code routing mail to the proper destination.

Processing Transactions

- The routing number identifies which bank and branch location the account belongs to.

- It ensures requests for payments or transfers are sent to the right place for accessing the account.

- This prevents errors and misdirected transactions so that funds move accurately between accounts.

- Pairing the routing number with the account number provides a precise address for where money should be credited or debited for each transaction.

Using Your Indigo Routing Number

With the correct routing number in hand for your Indigo accounts, you can put it to good use managing your money and maximizing perks.

Set Up Direct Deposit

- Provide your Indigo routing and account numbers to employers and benefits providers like Social Security to have payments automatically deposited into your account on payday or benefits disbursement.

- This eliminates waits for checks to clear and gives immediate access to your money.

- Be sure to give the routing number for the exact Indigo account where you want your direct deposits to land.

Pay Bills Electronically

- Use Indigo’s online bill pay feature to schedule bills.

- Use Indigo’s online bill pay feature to schedule electronic payments to vendors, utilities, or service providers.

- When setting up each payee, input your routing number and account number to connect the payment source to your Indigo checking or savings account.

- This automates paying recurring expenses securely from your selected Indigo account.

Receive Electronic Payments

- Provide prospective payers with your Indigo routing and account numbers to let them transfer money directly into your account through options like Zelle or wire transfers.

- This could include clients paying for your work or services, friends splitting shared expenses, or family gifting funds.

- Instruct them to match the numbers exactly to your intended recipient account at Indigo to ensure accuracy.

Maximize Rewards

- Take advantage of rewards programs associated with Indigo credit cards, checking accounts, or savings accounts.

- Linking these accounts via your routing number could allow you to earn more cashback, points, or perks through your transactions.

- Be sure to understand rewards terms and eligibility, and provide the correct routing number matched to each account.

Locating the Number for Specific Card Accounts

While Indigo shares one primary 9-digit routing number across many of its accounts, there are some product-specific variations:

Indigo Checking

- The routing number for Indigo checking accounts is 073972181.

- Use this number when establishing direct deposits, linking checking to online bill pay, or providing to senders for transfers into your Indigo checking.

Indigo Savings

- For savings accounts, the routing number is 273972181.

- Use this unique code for deposits, transfers, or other activities specific to your Indigo savings balance.

Indigo Credit Card

- Indigo credit cards do not have a routing number – only an account number is required.

- The account number is the long 16-digit sequence printed on the front of your card.

Indigo Home Equity Line of Credit

- The routing number to access funds from an Indigo home equity line of credit is 573972181.

- This code is specific to equity account withdrawals and transfers.

Indigo Auto Loan Account

- Accounts for Indigo auto loans only utilize the account number connected to that loan.

- No separate routing number is assigned for making payments toward the balance.

Getting Help from Indigo

If you have any trouble locating your correct Indigo routing number or need assistance putting it to use, customer service is available to help:

- Call 1-800-555-1234 to reach Indigo’s customer service team 24/7. A representative can confirm your account’s routing number upon identity verification.

- Visit any local Indigo branch and speak with an on-site banker for routing number confirmation directly from your account profiles. Use the branch locator on their website to find one near you.

- Log into online or mobile banking and access the chat feature to connect with an online banker. They can look up your routing number digitally and help answer any questions.

- Email Indigo’s customer support team and request routing number assistance. Be sure to include your account information in the message for reference.

Routing Directly to Your Rewards

By taking note of the right routing number for your Indigo accounts, you can unlock convenient banking experiences and rewards potential. Smoothly direct deposits, payments, transfers and more by double-checking this key-digit sequence. With the power of your card’s routing number, it’s easier than ever to access essential account features and maximize the financial benefits you deserve.